During the previous due diligence process, you will already have met many of our senior team as well as our excellent integration team. It's their job it is to ensure that the process of joining Clear is as seamless as it can be for you, your employees and your clients. They will deal with everything from managing insurer agencies through to making sure that your IT systems continue to work.

Once the deal is complete, its time to tell your employees. For this step, we like to be on hand to not only support your message but to meet with your employees in person, let them ask us questions, and to reassure them of any concerns that they may naturally have. The Clear Group have a wide range of popular employee benefits that will be available to your staff upon integration. We normally take this opportunity to explain some of them to your team so they can immediately see some of the personal advantages of joining a larger business.

This stage will also include communications, where we will prepare a press release with you as well as letters for clients and insurers. We understand that you may want to talk to some of your key clients in person, and we are also happy to meet with them if this is best for you.

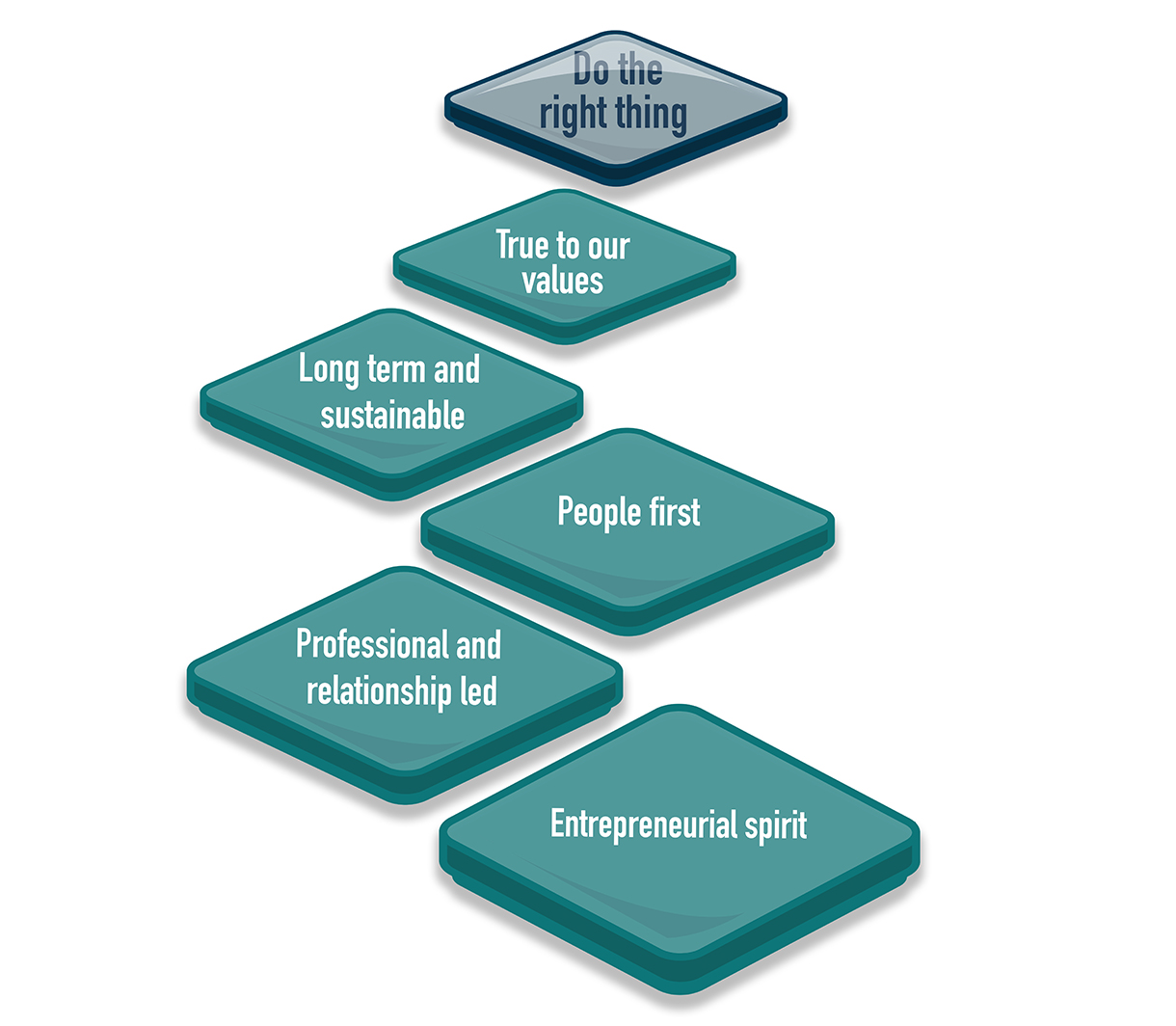

One thing you will find is that the amount of change following the sale is not nearly as dramatic as expected. Our approach is to acquire good businesses that already align with our values and philosophy. So, you will not find us radically changing how you work, dictating how you place business or taking a hatchet to your staff numbers or costs. We will offer the support that a larger business can offer, but in a collaborative way: we take on more of the administration and compliance workload, leaving you to look after your clients - to do what you do best.